Nepal Blue Book Calculator: Your Essential Guide to Vehicle Tax Renewal Made Simple

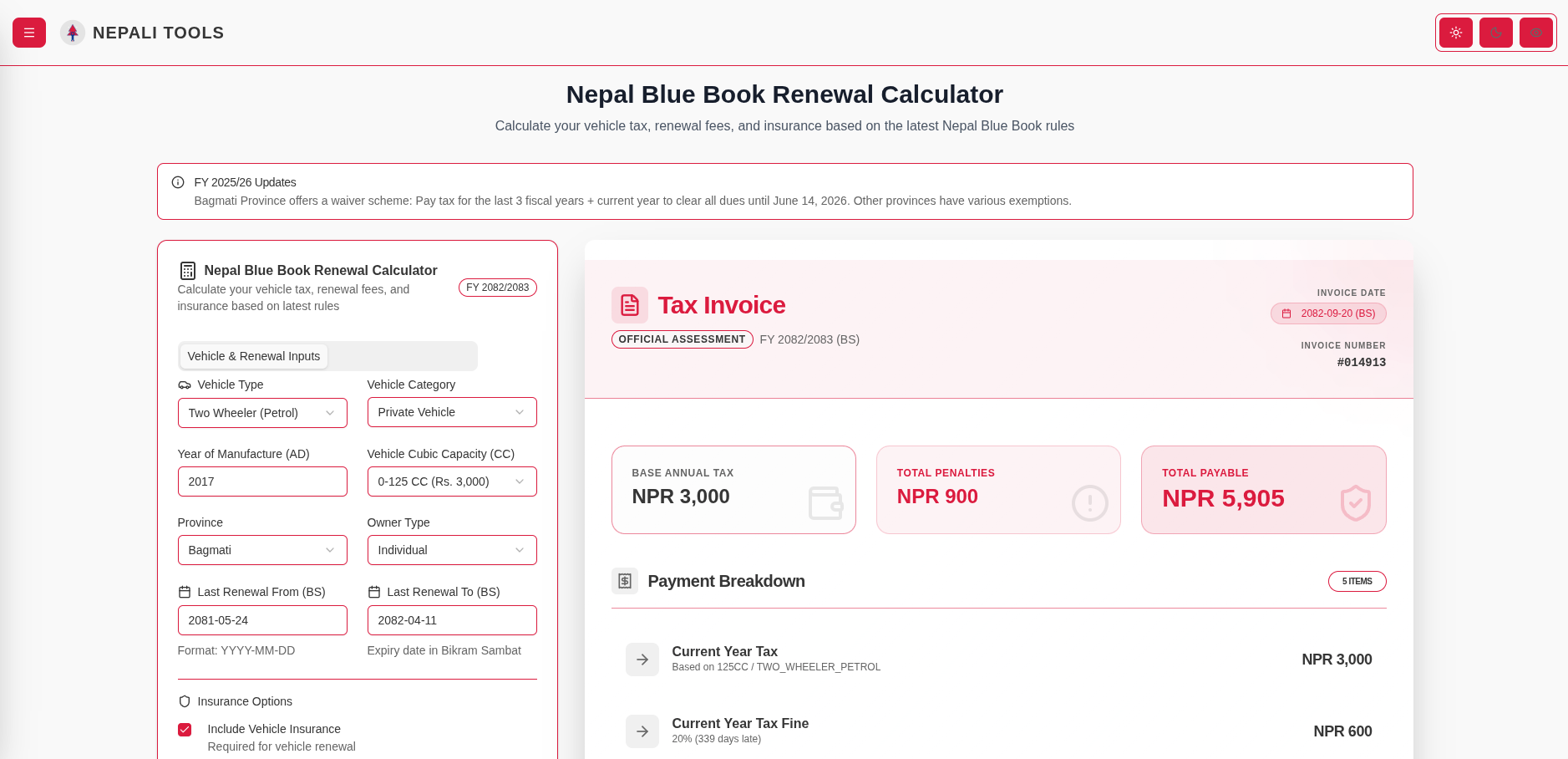

Image: A typical vehicle registration document showing tax calculation details

Image: A typical vehicle registration document showing tax calculation details

**Nepal Vehicle Bluebook Calculation: Click here to visit **

Introduction: The Pain Point Every Vehicle Owner Faces

If you've ever stood in a long queue at the Transport Management Office in Nepal, sweating through piles of paperwork while trying to figure out exactly how much you owe in vehicle taxes and penalties, you know the struggle is real. The complex web of rules, varying provincial policies, and ever-changing deadlines can turn a simple renewal process into a nightmare.

That's exactly why I created the Nepal Blue Book Renewal Calculator – to transform this confusing, time-consuming process into something as simple as filling out a form online. No more guesswork, no more surprise penalties, and no more wasted hours waiting in line only to discover you brought the wrong documents.

What Exactly Is the Nepal Blue Book Calculator?

The Nepal Blue Book Renewal Calculator is a free, web-based tool designed specifically for Nepali vehicle owners to accurately calculate their vehicle tax dues, renewal fees, penalties, and mandatory insurance costs. It's not just another generic calculator – it's built with the latest fiscal year rules (FY 2025/26) and incorporates all the recent policy changes from different provinces across Nepal.

Core Features That Set It Apart:

- Real-time Tax Calculations: Automatically computes your base annual tax based on vehicle type, engine capacity, and registration year

- Penalty Breakdown: Shows exactly how much you owe in late fees, broken down by days overdue

- Provincial Policy Integration: Accounts for different rules in Bagmati Province versus other provinces

- Insurance Calculator: Includes mandatory third-party insurance costs as required by law

- Waiver Scheme Support: Specifically handles Bagmati Province's special waiver scheme (pay last 3 years + current year to clear all dues until June 14, 2026)

- BS/AD Date Conversion: Works seamlessly with Bikram Sambat dates as used in official Nepali documents

This isn't just a calculator – it's your personal vehicle tax advisor that works 24/7, giving you the confidence to know exactly what you'll pay before you step foot in any government office.

How Does It Work? A Step-by-Step Walkthrough

Using the calculator is designed to be intuitive, even for those who aren't tech-savvy. Here's how it works in practice:

Step 1: Select Your Vehicle Details

You start by choosing your vehicle category (Two Wheeler Petrol, Private Vehicle, etc.), model year, and engine capacity. The system already knows the base tax rates for each category – for example, a 0-125 CC two-wheeler has a base tax of NPR 3,000 for the current fiscal year.

Step 2: Choose Your Province and Ownership Type

Different provinces in Nepal have varying tax structures and penalty systems. Bagmati Province currently offers that special waiver scheme I mentioned, while other provinces have their own exemptions. You also select whether you're an individual owner or a company – this affects certain calculation aspects.

Step 3: Enter Registration and Expiry Dates

This is where the calculator shines. By entering your vehicle's registration date and the expiry date (in Bikram Sambat format), the system automatically calculates:

- How many days you're late for renewal

- The exact penalty percentages that apply

- Whether you qualify for any current waiver schemes

Step 4: Insurance Selection

Since third-party insurance is mandatory for vehicle renewal in Nepal, the calculator includes this cost automatically. You can see exactly how much the insurance will cost based on current Nepal Insurance Authority guidelines.

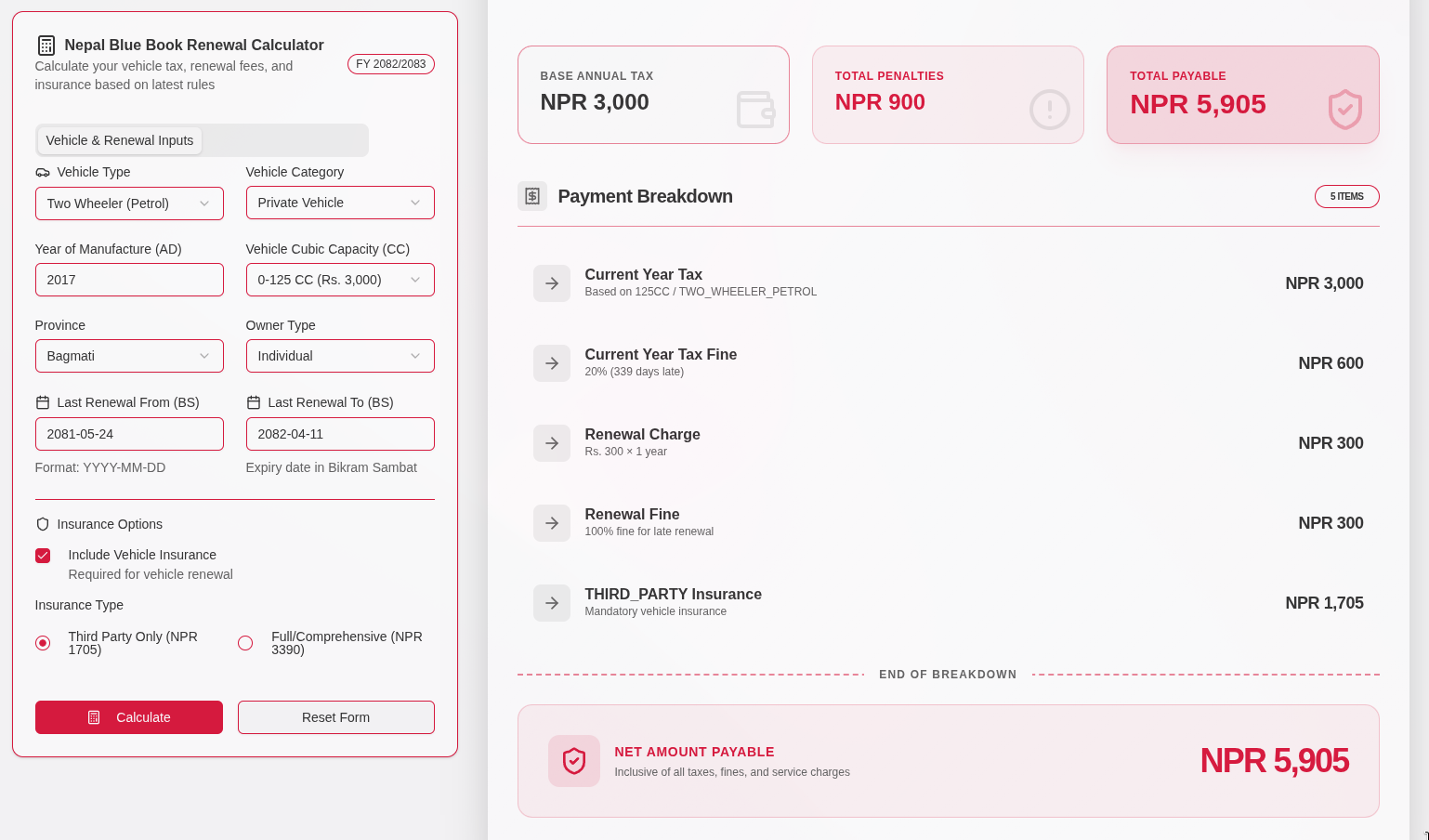

Step 5: Instant Calculation and Breakdown

With one click, you get a complete, itemized breakdown of your total payable amount. No hidden fees, no surprises – just a clear, official-looking invoice that shows:

- Base annual tax

- Current year tax fine (if applicable)

- Renewal charges

- Renewal fines

- Third-party insurance cost

- Total amount payable

The best part? You can use this calculation directly to the Transport Management Office as a reference, or use it to budget your payments ahead of time.

Image: This image show form with input fields and value along with Result UI

Image: This image show form with input fields and value along with Result UI

Why This Tool Matters: Solving Real Problems for Real People

You might be wondering, "Why do we need another online calculator?" The truth is, the existing options were either outdated, incomplete, or required you to understand complex tax codes just to get a simple estimate.

The Human Impact Behind the Code

I created this tool after witnessing countless vehicle owners face these challenges:

The Financial Surprise: Many people arrive at renewal offices only to discover they owe thousands more than expected due to penalties they didn't know about. The calculator eliminates this shock by showing exactly how penalties accumulate – for example, that 20% fine for 339 days late, plus 100% renewal fine for late renewal.

The Time Drain: In Nepal's busy cities, taking a day off work to stand in line at the Transport Management Office is a luxury many can't afford. With this calculator, you can do your homework from home, know exactly what to bring, and often complete the process in a single visit.

The Policy Confusion: With each province implementing different rules and waiver schemes, even experienced vehicle owners get confused. The Bagmati Province waiver scheme (pay last 3 years + current year to clear all dues until June 14, 2026) is a perfect example – it's complex but potentially saves thousands if you understand it.

The Documentation Anxiety: Not knowing which documents you need or how much to pay creates unnecessary stress. The calculator gives you confidence and clarity before you even leave your house.

More Than Just Numbers: Building Trust in Digital Services

In a country where many still prefer cash transactions and face-to-face interactions with government offices, this tool bridges the gap between traditional bureaucracy and modern digital convenience. It's designed to be trustworthy – citing official references like the Motor Vehicle and Transport Management Act, Bagmati Province Economic Act, and Nepal Insurance Authority guidelines – so users know the calculations are legitimate and up-to-date.

When Should You Use This Calculator? Perfect Timing Scenarios

The beauty of this tool is its versatility. Here are the key moments when it becomes indispensable:

Before Your Renewal Date (Proactive Planning)

Use the calculator 1-2 months before your renewal date to:

- Budget for upcoming expenses

- Decide whether to renew early to avoid penalties

- Compare costs across different provinces if you're considering changing your vehicle's registration

After Missing Your Renewal Date (Damage Control)

If you've already missed your renewal deadline, the calculator helps you:

- Understand exactly how much penalties are costing you each day

- Determine if you qualify for any current waiver schemes

- Plan your payment strategy to minimize total costs

During Provincial Waiver Periods (Strategic Savings)

When provinces announce special waiver schemes (like Bagmati's current offer), timing is everything. The calculator helps you:

- Verify if you're eligible for the scheme

- Calculate potential savings compared to regular renewal

- Determine the exact amount needed to clear all dues under the waiver

When Purchasing a Used Vehicle (Due Diligence)

Buying a used vehicle? Use the calculator to:

- Estimate pending tax liabilities from previous owners

- Factor these costs into your purchase decision

- Understand renewal requirements before completing the purchase

Annual Budgeting for Fleet Owners (Business Planning)

For businesses with multiple vehicles, the calculator enables:

- Accurate annual budgeting for vehicle maintenance costs

- Strategic planning around renewal dates to optimize cash flow

- Comparison of costs across different vehicle types and provinces

The Technical Backbone: Built for Accuracy and Reliability

While users see a simple interface, behind the scenes, the calculator is built on a foundation of official government policies and regularly updated databases:

- Legal Framework Integration: All calculations are based on the Motor Vehicle and Transport Management Act (2049 BS), provincial economic acts, and Nepal Insurance Authority guidelines

- Dynamic Date Handling: The system automatically converts between Bikram Sambat and Gregorian calendars, understanding fiscal year boundaries and penalty accumulation periods

- Province-Specific Logic: Each province's unique tax structures and waiver schemes are programmed as separate calculation modules

- Real-time Updates: The system is designed to incorporate new government circulars and policy changes as they're announced

- Transparent Calculations: Every number shown includes the exact formula and legal basis used to calculate it

This isn't a static tool that will become outdated next month – it's built with a maintenance framework that allows for regular updates as Nepal's vehicle taxation policies evolve.

Beyond the Calculator: The Vision for Nepali Tools

The Blue Book Calculator is just one piece of a larger vision. It lives alongside other essential utilities in the "Nepali Tools" suite, including currency converters, vehicle fare finders, and NP domain letter generators. Each tool addresses a specific pain point in daily Nepali life, transforming complex bureaucratic processes into simple digital interactions.

The philosophy is simple: technology should serve people, not the other way around. By making government-related processes more transparent and accessible, we can reduce corruption opportunities, save people time and money, and build greater trust in digital services across Nepal.

Getting Started: Your Next Steps

Ready to simplify your vehicle renewal process? Visit the Nepal Blue Book Calculator at:

https://tools.binodnagarkoti.com.np/blue-book-calculation

The tool is completely free to use, requires no registration, and works on any device with a web browser. Whether you're renewing a small scooter or managing a fleet of commercial vehicles, you'll get accurate, official-grade calculations in seconds.

Pro Tips for First-Time Users:

- Have your vehicle registration documents handy for accurate details

- Check the "FY 2025/26 Updates" section for current waiver schemes

- Take a screenshot of your calculation results to show at the Transport Management Office

- Use the calculator multiple times with different dates to find the most cost-effective renewal strategy

Conclusion: More Than a Tool – A Movement Toward Digital Nepal

What started as a personal frustration with inefficient bureaucracy has evolved into a tool that's helping thousands of Nepali vehicle owners save time, money, and stress every month. But this is just the beginning.

The real power of tools like the Nepal Blue Book Calculator lies in their ability to democratize access to information and services. When citizens can understand exactly what they owe, why they owe it, and how to minimize their costs legally, it creates a more transparent, efficient relationship between people and government services.

I'm constantly working to improve this tool based on user feedback and policy changes. If you have suggestions for features or notice any discrepancies in calculations, please reach out – this tool exists to serve you, and your input makes it better for everyone.

In a world where technology often complicates rather than simplifies, the Nepal Blue Book Calculator stands as proof that digital tools can make everyday life genuinely easier. No more guesswork, no more surprises, no more wasted days – just clear, accurate information that puts you in control of your vehicle renewal process.

Remember: Knowledge is power, especially when dealing with government services. The Nepal Blue Book Calculator gives you that power back, one accurate calculation at a time.

About the Author: Binod Nagarkoti is a software developer and digital services advocate from Nepal, passionate about creating practical tools that solve real-world problems for Nepali citizens. The Nepal Blue Book Calculator is part of his ongoing mission to make government services more accessible, transparent, and user-friendly through technology.

Disclaimer: While every effort has been made to ensure calculation accuracy based on current government policies, final assessment by Transport Management Offices may vary. This tool is for estimation purposes only and should not be considered legal advice.